Welcome to the fourth edition of the Guru Gems Newsletter! A newsletter focused on unearthing investment wisdom from the world’s long-term investing masters. In case you missed the previous editions:

My goal is to build a portfolio of 8-12 stocks (the ‘Guru Gems’) that will hopefully beat the index in the long run.

Here is what you can expect in today’s newsletter:

Guru in the spotlight: Joel Greenblatt

The Magic Formula to achieve above average returns

Should we add Magnera Corp to our portfolio?

Let’s dive in …

Gotham

Joel Greenblatt is without a doubt one of the greatest money managers of all time. He started a hedge fund called Gotham Capital in 1985 and is famous for averaging 40% returns a year over 20 years.

He is also the author of 3 well-known books on investing, one of which is a New York Times bestseller.

The books should be mandatory reading for every investor. Below is a summary of each book and I highlighted the key learnings that I can apply for the Guru Gems portfolio.

[This part is a bit longer, so if you just want the main takeaway of each book, feel free to only read the 1-sentence summary and skip straight to the stock analysis :)]

1/ You Can Be A Stock Market Genius (1997)

The book in 1 sentence: “Look for special situations”Key insights:

The key message of the book is that individual investors can take opportunities of situations that professional investors cannot. For this, they should look into special situations like spinoffs, mergers, restructurings, …

Greenblatt explains each situation in more detail and illustrates them with real case studies where he himself made a significant profit.

An important point in the book, which also comes back in his 2 other books, is that individual investors typically benefit from looking at smaller cap stocks.

For institutions or investors managing billions of dollars, it’s generally not worth it to bother with individual companies with market capitalizations below $500 million or even $1 billion. They usually can’t buy enough of these companies to make it worth doing the work. (Warren Buffett famously said: “A fat wallet is the enemy of high investment returns”)

My takeaway:

A learning from this book would be to also look for Gurus who manage smaller size portfolios as there may be lesser followed and possibly undiscovered Gems to be found. A bonus would be to find stocks where there is some kind of special situation although these may not be the typical long-term holdings that I am looking for.

2/ The Little Book that (Still) Beats the Market (2005 & 2010)

The book in 1 sentence: “Buy a group of good companies (high return on capital) at bargain prices (high earnings yield)”Key insights:

Stock prices can move wildly in the short term, without a significant change in the underlying value of the company. (Benjamin Graham’s concept of ‘Mr. Market’)

Buying shares at a large discount to intrinsic value provides a ‘margin of safety’. (another concept from Graham)

If you stick to buying good companies (ones that have a high return on capital) and to buying those companies only at bargain prices (at prices that give you a high earnings yield), you can end up systematically buying many of the good companies that crazy Mr. Market has decided to literally give away.

The above is essentially the ‘Magic Formula’ and is an improved version of Benjamin Graham’s formula to buy a group of 20-30 companies whose stock prices were so low that the purchase price was actually lower than the proceeds that would be received from shutting down the business and selling the company’s assets.

The ‘Magic Formula’ chooses companies through a ranking system. Those companies that have both a high return on capital and a high earnings yield are the ones that the formula ranks as best.

The reason for buying a group of stocks rather than just a few, is that investors wouldn’t have to worry about a few bad purchases since on average this approach will pick good companies.

My takeaway:

To me, this book resonates a lot with what we learned from Terry Smith in our first newsletter: Buy Good Companies and Don’t Overpay. The better the company and the lower we can buy it, the higher our potential returns will be.

Joel Greenblatt’s formula applies this principle for a group of companies, which should help investors who don’t have the knowledge or the time to analyze individual companies in detail. He even created a website that people can use to screen for companies that fit the Magic Formula criteria.

Ever since I read this book for the first time many years ago, I have been really intrigued by this Magic Formula. I never actually implemented it myself, also because at the time, the broker transaction fees were still quite high. (and the approach would require buying 20-30 companies and holding them for just a year and then repeat the process)

I am now thinking this could be a nice little side portfolio (The Guru Gems ‘Magic’ or ‘J.G.’ portfolio) to run as an experiment…

3/ The Big Secret for the Small Investor (2011)

The book in 1 sentence: “Over time, actively managed funds are outperformed by a market-cap weighted index fund which itself is outperformed by an equally weighted index fund which is outperformed by a fundamentally weighted index fund which is outperformed by a value-weighted index fund.”Key insights:

Greenblatt’s third book builds very much on his first 2 books. Here is an extract from the introduction:

[…] Then again, this is my third investing book. The first one, You Can Be a Stock Market Genius (yes, I know, I know), was meant to help the individual investor, too. It didn’t. It assumed investors had a lot of specialized investment knowledge and a lot of free time. (Actually, it did end up helping a few dozen hedge fund managers, but …) My second book, The Little Book That Beats the Market, gave a step-by-step method for the individual investor to just “do it yourself.” I still believe strongly in this method and I still love that book. But here, too, I missed the boat. As it turns out, most people don’t want to do it themselves. Yes, they want to understand it. But they still want someone else to do it for them.

So maybe the third time really is the charm. The Big Secret for the Small Investor should be a great answer for many investors. […]

The big secret is essentially:

to invest in a value-weighted index fund which should outperform other types of index funds and;

to hold on for a long time…

Greenblatt first argues that equally weighted indexes (i.e. each stock has an equal weight regardless of market cap) and fundamentally weighted indexes (i.e. weighting by sales or dividends or book value) beat market-cap-weighted indexes over the long term.

He then explains why value-weighted indexes (i.e. weighting by ‘cheapness’ - so higher weights for the ones that are cheaper and lower weights for the ones that are more expensive) beat all other indexes. He is basically applying the learnings from his second book in the form an index fund.

My takeaway:

It may not be a bad idea for individual investors who put the majority of their money in index funds, to also consider putting a portion in a value-weighted index fund.

In 2020 Greenblatt introduced an ETF that does exactly this.

Looking for Gems in Gotham City

While Joel Greenblatt is certainly an investing master, it may be difficult to pick Gems from his portfolio (he currently manages Gotham Asset Management, the successor to Gotham Capital).

The reason for this is that he applies his approach of buying groups of companies based on certain criteria and hence the change from quarter to quarter can be quite significant, making it difficult to identify individual Gems.

Therefore, rather than looking into Greenblatt’s portfolio for Gems, I will look for companies that fit the criteria that made Greenblatt so successful in the early days.

One such company is Magnera Corp, a specialty materials and nonwovens manufacturer. It does primarily B2B manufacturing – Magnera produces rolls of nonwoven fabric, films, and fiber-based materials which it sells to product manufacturers, for example diaper companies.

It’s a textbook example of what Greenblatt would describe as a ‘special situation’ stock: the company was created by merging Berry Global’s Health, Hygiene & Specialties nonwovens division with Glatfelter Corporation in late 2024. And with a market cap of $500M, this is also a small-cap stock and hence something many of the institutional investor will likely not even consider for their portfolio.

It is probably also not a coincidence that Michael Burry initiated a position in Magnera in Q4 of 2024. Burry (a doctor turned investor) became famous for his massive bet against the housing bubble in 2008 and was portrayed in ‘The Big Short’ book and movie. Burry (who had read Greenblatt’s first book) started investing as a passion and Joel Greenblatt had taken an interest in his blog and eventually became Burry’s first investor.

Similar to Greenblatt, it may be difficult to look for Gems in Burry’s portfolio, because it can change dramatically from quarter to quarter. As with his bet against the housing bubble, he also regularly uses short positions and stock options to bet on stocks or the market going down, making it very difficult to know his rationale, especially since the information is only available with a 45-day delay.

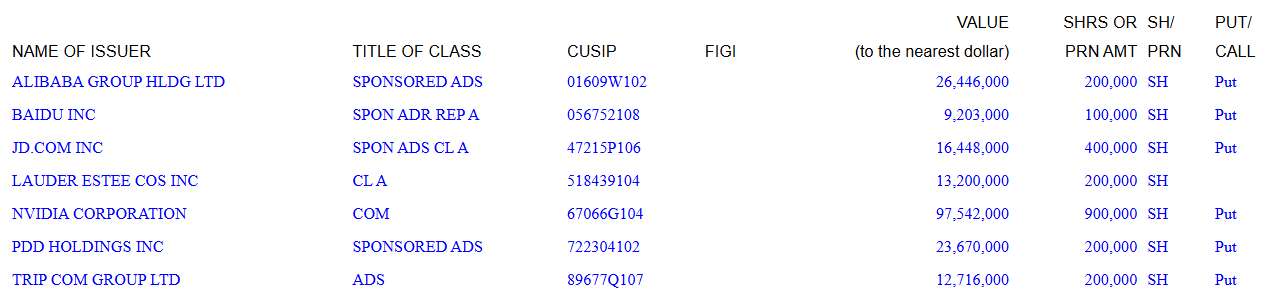

In fact, as I am writing this, the 13F filings for Q1 positions were just released and Burry basically sold all of his positions (including Magnera) except for one (Estee Lauder). He bought a significant amount of put options (which give the holder the right to sell a stock at a certain price) on NVIDIA and Chinese tech stocks, betting on a sell-off in both.

Remember that the 13F filing reflects the holdings on 31st March, which was just a few days before the massive sell-off from the Liberation Day tariff announcements. So Burry may have once again made a big win here…

To buy or not to buy

This is the part where we decide whether to add Magnera to our Guru Gems portfolio or not. For this, let’s apply Terry Smith’s approach like we did for previous portfolio candidates:

1/ Buy Good Companies

I’ll highlight a few things that stood out when researching the company:

Thanks to the merger, Magnera is now the largest nonwovens company in the world, which could be an advantage in serving big customers requiring a global supplier

The merger was structured as a spinoff with new debt financing, resulting in a net debt position of nearly $1.8B, or 4x net debt/EBITDA, which is significant and leaves very little margin for error, for example if there were to be any unexpected downturn in cash flow

Management has outlined a plan to realize $55M in synergies, but failure to execute on this (or taking too long to achieve) would have a big impact on the valuation

Kingdom Capital Advisors, a fund focused on small-caps and micro-caps, also initiated a position in Q4:

“In our last letter, we noted Magnera could potentially benefit from tariffs. We were pleased with their February report, after which insiders stepped up and bought shares in the open market, including a $500k purchase from the new CEO. I consider Magnera a well-managed industry leader trading for an attractive valuation in a defensive category, trading for a trough multiple on trough earnings. We were very happy with their rollout as a public company, and we were not alone, as many notable funds have filed ownership of the stock on their latest 13F reports. Of note, we did buy some puts on the XLP ETF tied to this position, as it contains many of Magnera’s end customers. If those businesses weaken, we will have some protection.”

Finally, as mentioned above there was some significant insider buying from the CEO and a few directors over the past weeks

2/ Don’t Overpay

Michael Burry and Kingdom Capital Advisors initiated their position in Q4 2024; the lowest price during that period was around $17

The current price (closing price on Friday 16 May) is $13, meaning I could buy it cheaper than the Superinvestors

Magnera’s Price-to-Book (P/B) ratio (a ratio we introduced last week when talking about Berkshire) is 0.7 (some sources quote 0.4), indicating that it might be undervalued

3/ Final decision

When researching Magnera, I came across an OpenAI Deep Research report on Reddit. Here is a paragraph that summarizes it well:

In short, Magnera’s appeal to a deep-value investor lies in the disconnect between its intrinsic business value and its current market price. The company has the hallmarks of an undervalued stock: low P/B, high FCF yield, a misunderstood story, and a near-term cloud (integration and debt) that, if cleared, could lead to a significantly higher valuation. The presence of a high-profile value investor like Michael Burry underscores the thesis that Magnera might be a diamond in the rough for those willing to stomach the short-term noise.

Overall, it feels quite risky and Magnera doesn’t really look like a Gem which a long-term Guru may keep in their portfolio. At the same time, it seems to fit many of the criteria described by Greenblatt in his first book.

Therefore, I decided to make Magnera a very small position in the Guru Gems portfolio for now (1-2%). I will closely monitor the company going forward and look for other Gurus or funds that have added Magnera to their portfolio to better understand the risk or the right time to exit.

Learn more about the Gurus

I hope you enjoyed this newsletter. If you are new to investing or curious to learn more about investing Gurus, I would highly recommend William Green's book Richer, Wiser, Happier. It's a fantastic book about how the world's greatest investors win in markets and life. There is also a podcast under the same name (the episodes are featured on The Investor’s Podcast Network). Here is the episode with Joel Greenblatt (one of my favorite episodes):

The ‘Magic Formula’ chooses companies through a ranking system. Those companies that have both a high return on capital and a high earnings yield are the ones that the formula ranks as best.

2 + 3 ≠ 2 “+” 3

2 + 3 = 2 × 3

Ranking Formula:

ROC × E/P